The Impact of Cryptocurrency on Global Economies and Financial Systems

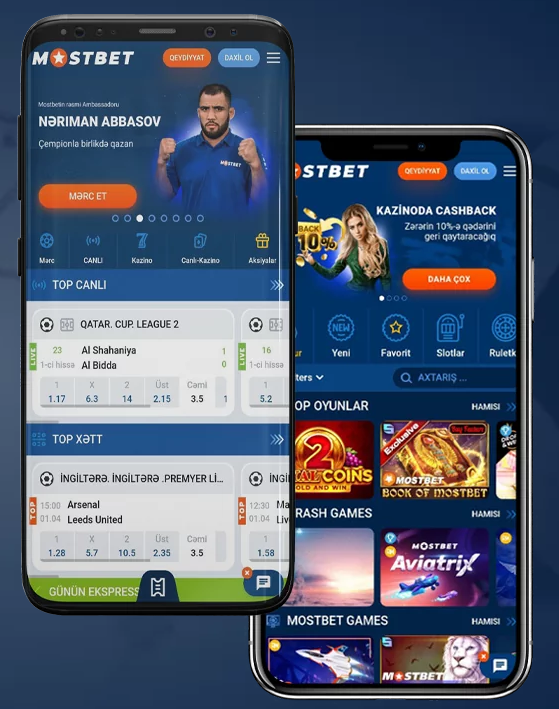

In recent years, cryptocurrency has emerged as a pivotal force that is reshaping global economies and financial systems. With its decentralized nature, cryptocurrency offers an alternative to traditional banking systems and has the potential to change the way we perceive and conduct financial transactions. As the world becomes increasingly digital, understanding the impact of cryptocurrency is essential for individuals, investors, and governments alike. Notably, many platforms and services are capitalizing on the crypto trend, with The Impact of Cryptocurrency on Online Casinos in Bangladesh Mostbet bd being one of the many entities integrating cryptocurrencies into their operations.

The Rise of Cryptocurrency

The introduction of Bitcoin in 2009 marked the beginning of the cryptocurrency revolution. Created by an anonymous person or group under the pseudonym Satoshi Nakamoto, Bitcoin offered an innovative solution to the issues of trust and transparency in financial transactions. Its underlying technology, blockchain, enables secure, peer-to-peer transactions without the need for intermediaries, such as banks. Over the years, thousands of cryptocurrencies have emerged, including Ethereum, Ripple, and Litecoin, each contributing to a growing ecosystem that is now valued at trillions of dollars.

Disruption of Traditional Financial Systems

One of the most profound impacts of cryptocurrency is its potential to disrupt traditional financial systems. Central banks and financial institutions have long held the reins on monetary policy and currency control. However, cryptocurrencies operate outside this framework, raising questions about the future role of banks and regulators. As more individuals shift towards using cryptocurrencies for transactions, traditional banks could face declining relevance.

Moreover, the decentralized nature of cryptocurrencies means that they can be accessed and utilized by anyone with an internet connection. This inclusivity is particularly transformative for individuals in underbanked regions where access to traditional banking services is limited. Cryptocurrencies can empower these populations by providing them with the tools to participate in the global economy.

Financial Inclusion and Empowerment

The potential for cryptocurrencies to provide financial inclusion cannot be overstated. In developing countries, millions of people lack access to basic banking services. Cryptocurrencies, through digital wallets and mobile apps, offer an alternative avenue for storing value and making transactions. This newfound financial access can lead to increased economic activity and improved living standards for those who were previously excluded from the financial system.

Moreover, cryptocurrencies allow for faster and cheaper cross-border transactions compared to traditional banking methods. For example, remittances sent through the conventional banking system may incur high fees and take several days to process. Cryptocurrencies allow for almost instantaneous transfers at a fraction of the cost, making them a popular choice for expatriates sending money back home.

Investment and Speculation

The emergence of cryptocurrency has also created new investment opportunities. As more individuals recognize the potential for substantial returns, the crypto market has drawn in both retail and institutional investors. Major corporations, hedge funds, and financial institutions are now allocating a portion of their portfolios to cryptocurrencies, further legitimizing the asset class.

However, this influx of investment has also led to concerns surrounding market volatility. The prices of cryptocurrencies can fluctuate wildly, leading to significant gains or losses in a short period. For many investors, this volatility creates opportunities for speculation, attracting risk-tolerant individuals who seek quick profits. Nevertheless, it is crucial for investors to approach cryptocurrency with caution, understanding the risks involved and the importance of diversifying their portfolios.

Regulatory Challenges

As cryptocurrencies gain prominence, governments around the world are grappling with how to regulate this new asset class. Regulatory frameworks vary significantly from one country to another, creating an unpredictable environment for investors and businesses. In some jurisdictions, cryptocurrencies are embraced, while others impose strict regulations or outright bans.

The challenge for regulators is to balance protecting consumers and preventing illicit activities, such as money laundering and tax evasion, with the need to foster innovation and economic growth. Striking this balance is crucial as cryptocurrency continues to gain traction on a global scale, particularly given the rise of decentralized finance (DeFi) platforms that seek to provide financial services without traditional intermediaries.

Environmental Considerations

The environmental impact of cryptocurrency mining, particularly Bitcoin, has come under intense scrutiny. The process of mining, which involves solving complex mathematical equations to validate transactions, requires substantial amounts of energy. Critics argue that this energy consumption contributes significantly to carbon emissions and climate change. As cryptocurrencies become more mainstream, addressing these environmental concerns is imperative for the industry’s long-term sustainability.

In response, many projects are exploring more energy-efficient consensus mechanisms, such as proof-of-stake. These alternatives aim to reduce the environmental footprint of cryptocurrency transactions while maintaining the security and integrity of the blockchain.

The Future of Cryptocurrency

The future of cryptocurrency is filled with potential and uncertainties. As technological advancements continue to shape the landscape, we may witness the integration of cryptocurrencies into everyday transactions, further blurring the lines between traditional and digital currencies. Central Bank Digital Currencies (CBDCs) are also being explored by several nations, signaling a recognition of the need for innovation within the monetary system.

Despite the challenges, the impact of cryptocurrency on global economies and financial systems can no longer be ignored. As consumers and businesses alike embrace this new financial paradigm, the demand for transparency, security, and efficiency will likely drive further innovation in the space. Embracing the potential of cryptocurrency, while navigating its complexities, may lead to a more inclusive and dynamic global economy.

Conclusion

Cryptocurrency is more than just a technological innovation; it is a movement toward a decentralized and more equitable financial world. Its impact on global economies, financial systems, and individual empowerment is profound. As we forge ahead, it is crucial for stakeholders to engage in meaningful conversations about the regulation, sustainability, and future of cryptocurrencies to ensure they serve as a force for positive change in our world.