In recent years, the concept of tokenized real estate has emerged as one of the most transformative developments in the property investment landscape. By leveraging blockchain technology and digital tokens, this innovative approach enables fractional ownership of real estate assets, thus broadening access to property investments for a diverse range of investors. In light of this rapid evolution, tokenized real estate metadefiassets.com plays a significant role in the tokenization market, providing essential services and insights.

Understanding Tokenized Real Estate

Tokenized real estate refers to the process of converting ownership rights in a property into digital tokens stored on a blockchain. This process allows portions of real estate assets to be bought, sold, and traded like shares in a company. Traditional real estate investing often requires large capital and significant administrative effort, deterring many potential investors. Tokenization addresses these barriers by enabling fractional investments, thereby opening up real estate markets to a broader audience.

The Mechanics of Tokenization

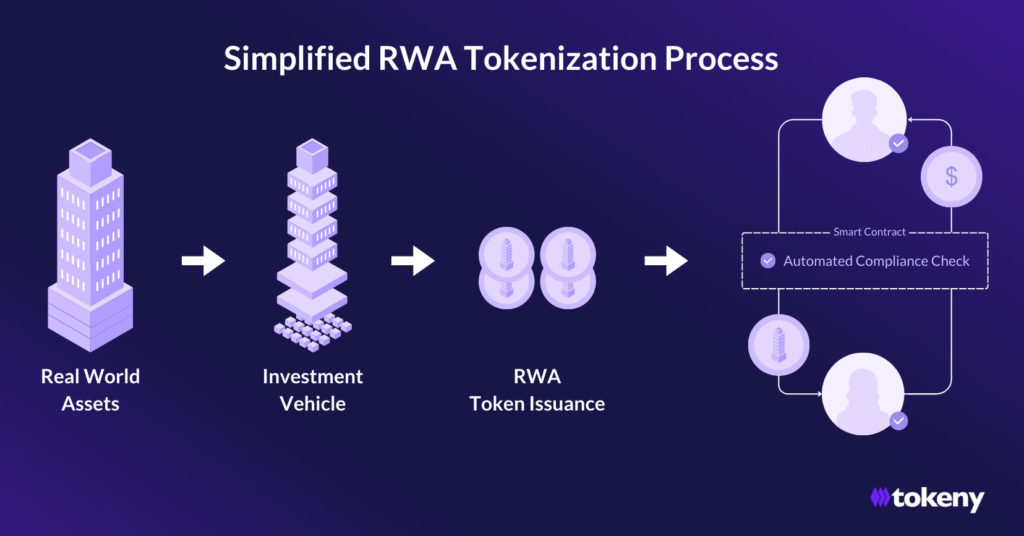

The process of tokenizing real estate typically involves the following steps:

- Asset Identification: Real estate assets are identified for tokenization. These can include residential homes, commercial properties, or even land.

- Legal Structure: A legal framework is established to ensure compliance with local regulations, protecting the interests of investors.

- Token Issuance: Digital tokens representing ownership shares of the asset are created and deployed on a blockchain.

- Marketplace Launch: These tokens are made available on a marketplace, allowing investors to purchase them.

- Management and Distribution: Property management services are provided, and profits such as rental income are distributed to token holders.

Benefits of Tokenized Real Estate

Tokenized real estate offers numerous advantages, both for investors and property owners:

- Lower Entry Barriers: By allowing fractional ownership, tokenization makes it possible for individuals to invest in real estate with smaller amounts of capital.

- Liquidity: Tokens can be traded on specialized platforms, increasing liquidity compared to traditional real estate investments.

- Transparency: Blockchain technology provides a transparent ledger of ownership and transactions, reducing the risk of fraud and increasing trust among investors.

- Diverse Portfolio Opportunities: Tokenization allows investors to diversify their portfolios by investing in multiple properties across various locations and asset types.

- Automated Processes: Smart contracts facilitate automated processes such as rental income distribution and compliance management, lowering operational costs.

Real-World Applications

Several companies have already begun to explore the potential of tokenized real estate. Here are a few notable applications:

- Fractional Ownership Platforms: Companies like RealT and SolidBlock allow users to buy fractional shares of properties, making high-value real estate accessible to everyday investors.

- Real Estate Investment Trusts (REITs): Tokenized REITs combine the benefits of traditional REITs with the advantages of blockchain, enabling investors to hold shares in various properties through tokens.

- Tokenized Asset Exchanges: Platforms such as REIBlocks facilitate trading of real estate tokens, providing a marketplace for liquidity.

- Global Investment Opportunities: Investors can access international markets and properties without dealing with foreign regulations and complexities.

Challenges and Considerations

Despite its many benefits, tokenized real estate also presents several challenges that must be addressed:

- Regulation: The legal status of tokenized assets varies by jurisdiction, which can pose compliance challenges for companies and investors.

- Market Maturity: The tokenization market is still relatively new, and broader adoption will take time as market participants become more accustomed to this model.

- Security Concerns: Cybersecurity measures must be robust to prevent hacks or breaches that can jeopardize the value of tokenized assets.

- Valuation Methods: Establishing standardized methods for valuing tokenized properties remains a topic of discussion among industry experts.

The Future of Tokenized Real Estate

As technology continues to advance and more stakeholders express interest, the future of tokenized real estate is promising. The potential for increased democratization of property investment, paired with the allure of accessibility and liquidity, is likely to drive further growth in this sector.

Industry leaders and innovators are working diligently to address the challenges mentioned earlier, ensuring that tokenized real estate can meet the needs of investors and property owners alike. As platforms like metadefiassets.com emerge, they will likely play a pivotal role in shaping the future of this revolutionary investment model.

Conclusion

Tokenized real estate represents a groundbreaking shift in the investment landscape, providing individuals with unparalleled access to property markets. As technology continues to evolve, the opportunities for innovative investment models will only expand. Embracing tokenization may empower a new generation of investors, democratizing property ownership and transforming the way we think about real estate investments.