How to Put Money Into Investment Accounts: A Comprehensive Guide

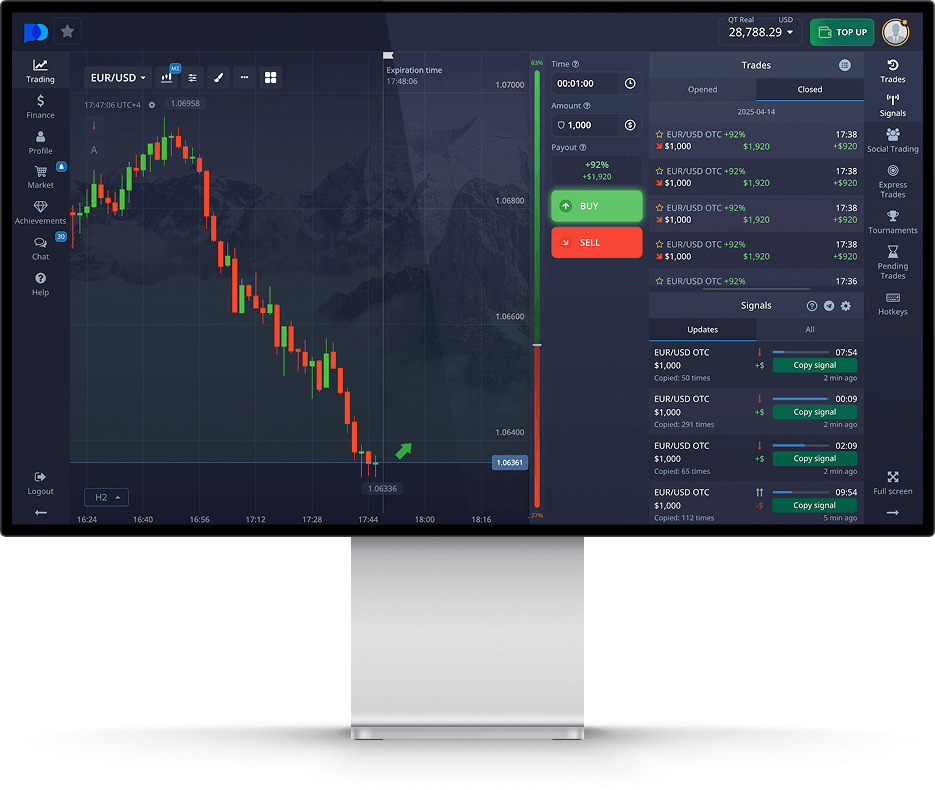

Investing can be a great way to grow your wealth over time, but before you can start reaping the rewards, you need to figure out how to put money in to your investment accounts. Whether you are a seasoned investor or just starting out, understanding the funding process is crucial. In this article, we will explore different methods to deposit funds, the pros and cons of each, and key considerations to help you make informed decisions. For those looking for a risk-free way to practice trading, consider starting with a demo account available at how to put money in pocket option https://pocketoption-ukraine.com/ru/demo-schet/.

1. Understanding Investment Accounts

Before diving into how to deposit money, it’s important to understand the types of investment accounts you might use:

- Brokerage Accounts: These accounts allow you to buy and sell a variety of investment products including stocks, ETFs, mutual funds, and bonds.

- Retirement Accounts: Accounts such as 401(k)s and IRAs help you save for retirement with tax advantages.

- Education Savings Accounts: 529 plans or Coverdell accounts designed for educational expenses.

Each type of account may have different funding options and rules, so it’s essential to check with your financial institution regarding the specifics.

2. Common Methods to Deposit Money

Here are the most common methods to deposit money into your investment accounts:

2.1. Bank Transfers

This is the most straightforward method. You can link your bank account directly to your investment account and transfer funds electronically. Most platforms offer options like one-time transfers or recurring deposits tailored to your saving strategy.

2.2. Wire Transfers

Wire transfers are another popular funding method, especially for larger amounts. While they are secure and fast, some institutions may charge a fee. Additionally, ensure that you have the correct wiring instructions to avoid delays.

2.3. Checks

Writing a check remains a viable option, though it’s becoming less common. Simply fill out a check in the desired amount and mail it to your brokerage firm. Make sure you keep copies of your checks for your records.

2.4. Credit or Debit Cards

Some platforms allow you to fund your account using a credit or debit card. This method provides immediate access to funds but comes with high-interest rates if you don’t pay in full. Additionally, be aware of any transaction fees associated with this method.

2.5. Transfers from Other Investment Accounts

If you’re migrating to a new broker, you can often transfer accounts in-kind. This means you can move not just cash, but also stocks or other assets from one brokerage to another without buying or selling them first.

3. Factors to Consider When Funding Your Investment Account

When selecting a method to put money into your investment account, consider the following:

- Speed of Deposit: Some methods offer immediate funding while others may take days.

- Fees: Be aware of any associated fees for different funding options, as they can diminish your investment capital.

- Limits: Most platforms have minimum and maximum deposit limits; check these before funding your account.

- Security: Ensure that you use methods that provide the highest security to protect your financial data.

4. Best Practices for Funding Your Investment Account

Here are some best practices to follow:

- Start Small: If you’re new to investing, start with a small amount to test the waters before committing larger sums.

- Automate Contributions: Set up automatic transfers to make saving easier and more consistent.

- Diversify Funding Sources: Don’t rely on a single method—consider using different funding sources for various accounts.

- Monitor Your Investments: Keep track of your account performance and adjust your funding strategies as necessary.

5. Capital Gains and Tax Implications

When you put money in and start making profits, it’s essential to be aware of capital gains taxes. This tax is applied to the profit from the sale of an asset. Understanding the tax implications of your investment decisions can help you maximize returns. Always consult a tax advisor to keep compliant with regulations.

6. Conclusion

Investing in your future requires a solid understanding of how to put money into your investment accounts effectively. There are various methods, each with its benefits and limitations. By considering how to fund your accounts, assessing the options available to you, and keeping an eye on fees and tax implications, you can take confident steps toward building your financial future. Let this guide serve as a roadmap as you embark on your investment journey.